Warden from Paladin: A solution for your veCRVs

If you have veCRV in the bottom of your wallet, but you are not suing your voting power, Warden is an interesting solution. This allows you to continue to collect the fees collected by Curve, in the form of Crv 3pool tokens, but also to earn additional CRV when someone borrows your veCRVs (your voting power to be more precise). To make this even simpler. Warden can be seen as an Aave for locked CRV (veCRV) and the voting power attached to it.

How does it work ?

Warden allows you to “rent” your voting power. Meaning that you make the voting power attached to your veCRVs available, so that another person can borrow it and thus use your voting power. In return, this user will pay you a rental, in the form of CRV.

This is therefore particularly interesting for users who do not use their voting power and who seek to generate a little yield with it.

Tuto

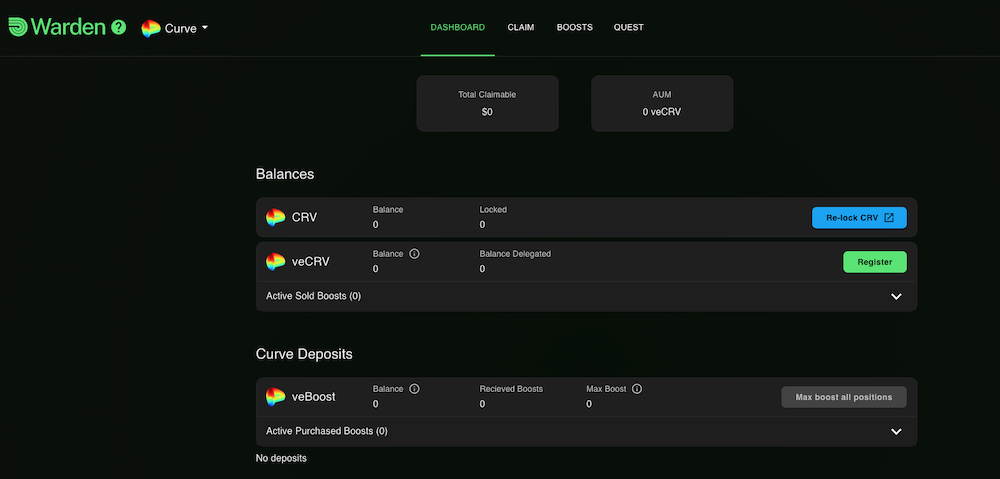

1/ You must first go to the Warden site: https://app.warden.vote/dashboard/

At this stage make sure you are in the “Curve part” of Warden (top left).

2/ Then go to the Dashboard

3/ Then click on Register if you already have veCRV, or on Re-Lock CRV if you only have CRV. This Button will send you to the Curve site so you can lock your CRV.

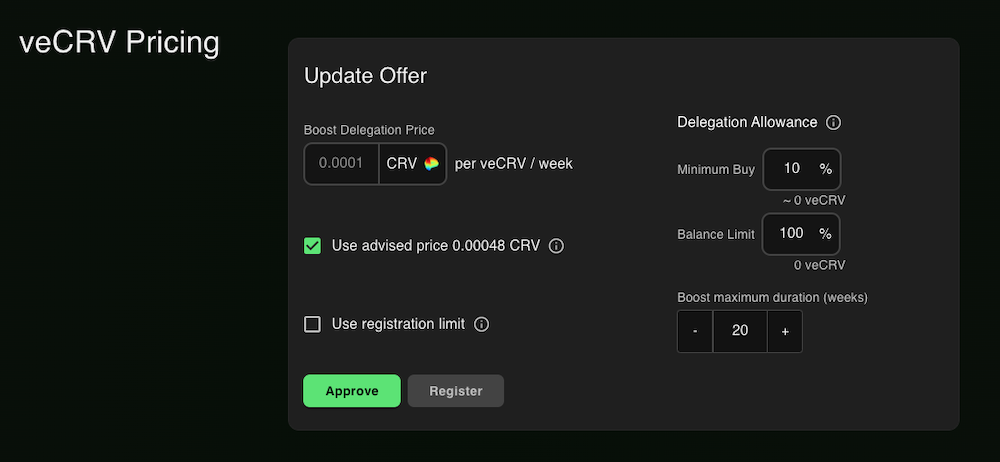

4/ This is the most important step because it allows you to define all the important parameters of your Offer.

5/ Firstly, you will have to indicate at what price you wish to rent your veBoost (the voting power of your veCRV). There are 2 options:

- Set a price yourself

- Use advised price (use advised price)

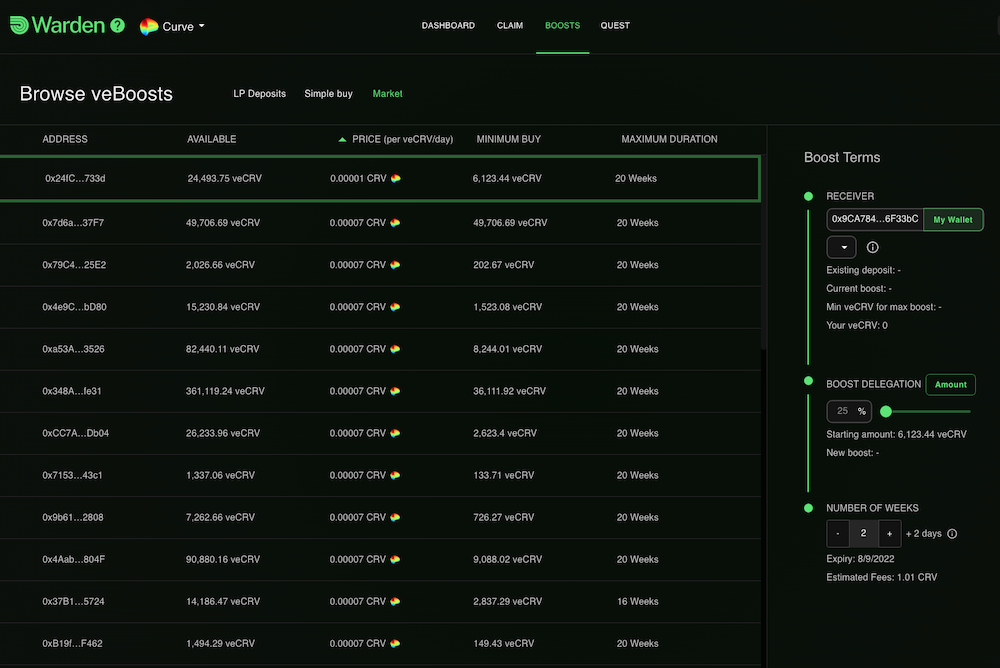

If you want to set the price yourself, it is interesting to go to the BOOSTS tab, then Market to see what the current market price is and know where you would place yourself according to the price. you want to set.

It is important to note that if you choose the recommended price, it will be automatically updated each time a new person offers their veCRV for rental. Indeed, this price is optimized for a healthy dynamics of the Boosts market and is constantly adjusted.

6/ Indicate the minimum % of your veBoost that a person must borrow for each loan (Minimum buy).

7/ Indicate the % of your veBoost that you wish to make available to borrowers (Balance Limit). Indeed, you are not obliged to make 100% of your veBoost available. This can be used by certain users who wish to keep part of their voting power.

It is important to note that if your veBoosts are not borrowed, you keep your voting power. On the contrary, if they are borrowed, you will lose it!

7/ Define the duration during which you want to make your veBoost available to borrowers and how long they can borrow them at most.

- Boost maximum duration (weeks) = the maximum duration during which someone can borrow your offer

- Registration limit = the date on which your offer is no longer available

It is important to note that if you indicate, for example, a “Registration limit” of 4 weeks, but 1 week before the end of this period someone takes a Boost with your offer, this offer will last for 4 weeks. That is to say 3 weeks more than your “registration limit”. So keep that in mind

Want to know more ?

You can visit their docs: https://doc.paladin.vote/warden/boost-market